You may have a different credit score for each credit bureau since your score is based on the information that that unique bureau has about you. These credit bureaus collect your credit information and sell it to creditors for a fee. In the United States, there are three credit bureaus, namely: Equifax, Experian, and Transunion. There Are 3 Credit Bureaus That Track Your Credit Information Length of credit history: the length of time that you have had credit accounts openĬredit mix: do you have different types of credit (student loan, car loan, mortgage)?Īmount of new credit: do you open new credit accounts only as needed? Your credit score is based on the following:Ĭredit utilization: the amount of credit extended to you that you actually use

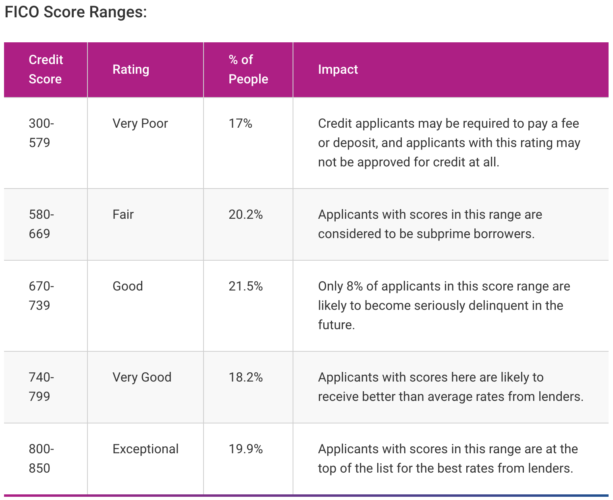

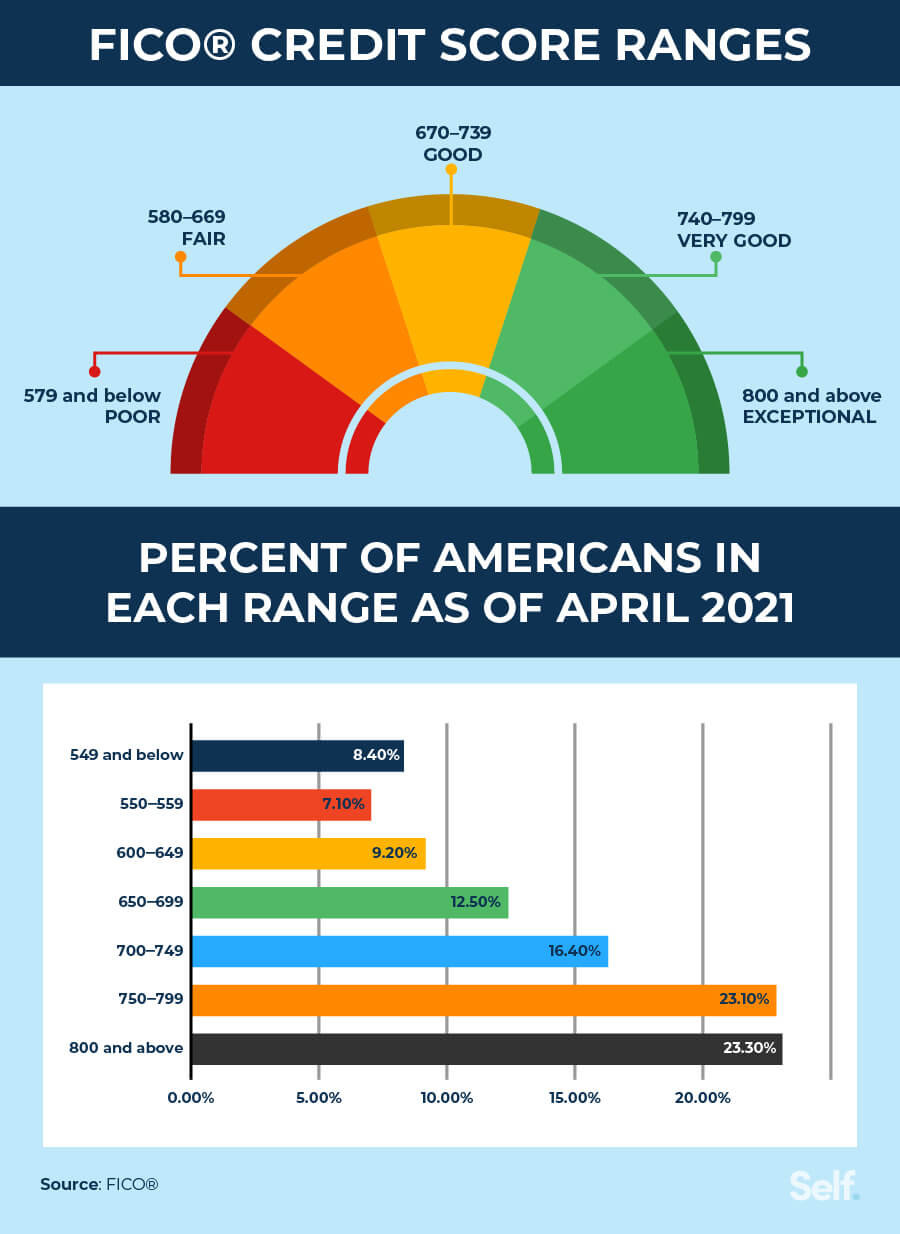

People with excellent credit scores can usually get the best interest rates on things like car loans and mortgages. An “excellent” credit score is 750 or above. FICO stands for Fair Isaac Corporation which was the first company to offer a credit score. Your US credit score, also known as your FICO score, can range from 300 to 850, and most people have a credit score between 600 and 750. Even if you aren’t looking to do those things now, you might want to in the future. Building credit can make it easier to apply for a mortgage, get a car loan, rent an apartment, or get a rewards credit card. While it’s possible to use cash day-to-day, it is a good idea to begin building a credit history as soon as possible. This can impede your ability to get approved for a credit card, apply for a mortgage, or engage in other types of financial transactions. However, all immigrants face a common barrier: a lack of US credit history. For more information, view: understanding the difference between credit scores.īy understanding your credit report and credit score – and checking them regularly for accuracy – you can make informed choices that will impact your financial future.When you are immigrating to the United States, it is natural to want to land on strong financial footing. When comparing scores, be sure to understand what kind of credit score you are looking at (FICO ® Credit Score vs VantageScore), what score version it is, and when it was last updated.

#Us credit score range free

Credit Close-Up ® offers eligible Wells Fargo Online ® customers free (complimentary) access to their FICO ® Score. Some banks and credit card companies also provide credit scores to their eligible customers. A VantageScore is not the same as a FICO ® Credit Score, and there are differences in how they are calculated. There are also websites that offer a free VantageScore. To access your credit score for a fee, you can contact the credit reporting agencies. A high credit score can indicate lower risk to the lender and customers with a high credit score may be more likely to qualify for a loan. If, once you have your credit score from all three agencies, any of those numbers are drastically different than the others, you may want to look closely at your credit reports to see if there are any errors which you can dispute. Each reporting agency will charge a fee to show your credit score. If you request your free annual credit report, it will not automatically include a credit score. When you request your credit score, you will actually receive three numbers in return, and since the numbers will be coming from different reporting agencies, they may all be different. There are three credit reporting agencies –Equifax ®, Experian ®, and TransUnion ® – each of which assigns you a credit score. This three-digit number typically ranges from 300 to 850, specifically those based on the standard FICO ® Score. What’s a credit score?Ī credit score is like a grade that’s given to your credit report.

The free annual credit report will not contain your credit score. By viewing your credit reports, you will be able to know what lenders will see when you apply for a loan. The Fair Credit Reporting Act allows consumers access to one free credit report annually from each of the three major credit reporting agencies through. Credit reports also list related public records, such as collections or bankruptcy filings. It outlines how much you owe creditors, how long each account has been open, and how consistently you make on-time payments. However, if you take a closer look, you may start to understand some key differences between the two.Ī credit report includes information about your past and existing credit agreements, such as credit card accounts, mortgages, and student loans, and lists inquiries about your credit history. Do you know the difference between your credit report and your credit score? It may be easy to see these two related items as one and the same.

0 kommentar(er)

0 kommentar(er)